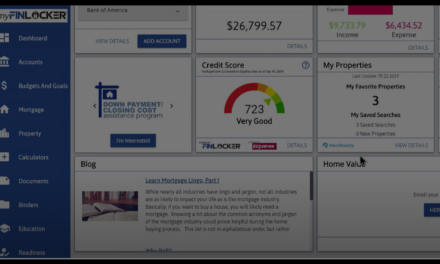

Category: Lenders

Digital SMB Lenders

Lending to small- and mid-sized businesses (SMB/SME) is further along than many fintech services. While there were a few players in the early 2000s (just 4 remain), the market exploded after the 2007/2008 financial crisis with 10 companies founded from 2007 to 2011 and another 13 from 2012 to 2015. The pace slowed with about 1 new company per year since then.

Businesses constantly need capital and smaller businesses have fewer options. So most digital fintech lenders are so-called alt-lenders, meaning they are an alternative to traditional financial institutions.

By using different underwriting techniques alt-lenders are able to lend to a much more diverse segment of businesses. This generally comes at substantially higher interest rates. But the comparison to legacy banks is meaningless. All that matters to the business is they make an acceptable risk-adjusted return on the borrowed funds. And to survive, alt-lenders make sure they only lend on terms that borrowers can make a profit on.

Small Business Lender of the Month*

1-Page, 1-Minute Application

Larger Offers | Lower Rates | Longer Terms | Business Line of Credit Funds in 24 Hours.

Here are the biggest digital SMB lenders in the United States:

The FAB Score Ranking (Fintech Attention Barometer) is a proxy for the size of a private fintech company.

| Company Overview | Learn More | FAB Score* | Founded | Funding $M | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| National Business Capital | Ad | 2007 | $120,000 | Apply | NYC | |||||||||||||||

| Capchase | 488 | 2020 | $950 | Apply | NYC | 12000 | ||||||||||||||

| Kabbage | 362 | 2008 | 2500 | Apply | Atlanta | 11 May 2021 | 1 | 360000 | 0 | 2500 | 4600 | 530 | 23000 | 500 | 6643 | 4.8 | 8303 | 4.9 | ||

| CLEARCO | 309 | 2015 | 699 | Apply | Toronto | 260000 | ||||||||||||||

| BlueVine | 282 | 2013 | $768 | Apply | SF | 11 May 2021 | 2 | 870000 | 75 | 693 | 79 | 2390 | 312 | 1390 | 4.6 | 9 | 4.6 | |||

| Pipe | 199 | 2019 | $323 | Apply | Miami, FL | 110,000 | ||||||||||||||

| OnDeck | 197 | 2007 | $1,200 | Apply | NYC | 11 May 2021 | 5 | 100,000 | 0 | 1200 | 548 | 11900 | 587 | 2405 | 4.9 | 10 | 2.3 | |||

| Nav | 182 | 2012 | $92 | Apply | Utah | 11 May 2021 | 7 | 850000 | 0 | 99 | ||||||||||

| Camino Financial | 177 | 2014 | $170 | Apply | LA | 11 May 2021 | 11 | 280000 | 0 | 20.4 | 6 | 722 | 103 | 28 | 1.8 | |||||

| Fundbox | 145 | 2013 | $554 | Apply | SF | 31 Mar 2020 | 10 | 180000 | 0 | 434 | 378 | 73 | 7720 | 277 | 1740 | 5 | 781 | 4.9 | ||

| Can Capital | 128 | 1998 | $1,002 | Apply | Atlanta | 11 May 2021 | 8 | 12000 | 0 | 1002 | 92 | 2110 | 200 | 695 | 4.5 | |||||

| Lendio | 106 | 2011 | $109 | Apply | Utah | 11 May 2021 | 4 | 400,000 | 0 | 109 | 100 | 11600 | 350 | 2292 | 4.9 | |||||

| Arc | 101 | 2021 | 181 | Apply | SF | |||||||||||||||

| Biz2Credit | 89 | 2007 | $387 | Apply | NYC | 18 May 2021 | 6 | 200,000 | 0 | 387 | ||||||||||

| 87 | 2013 | $19 | Apply | NYC | 11 May 2021 | 9 | 600,000 | 0 | 18.9 | 55 | 28600 | 96 | 628 | 4.8 | Lead gen | |||||

| Nuula | 67 | 2021 | $120 | Apply | Toronto | 9 Sep 2021 | 3,600 | |||||||||||||

| Novel Partners | 62 | 2018 | $115 | Apply | Overland Park, KS | |||||||||||||||

| Lighter Capital | 59 | 2010 | $116 | Apply | Seattle | 12 May 2021 | 13 | 81,000 | 16 | |||||||||||

| Lendistry | 56 | 2015 | 94.8 | Apply | LA (Brea) | 11 May 2021 | 12 | 43000 | $1.5 | 0 | ||||||||||

| Fund that Flip | 41 | 2014 | $33 | Apply | NYC | 11 May 2021 | 15 | 100,000 | 0 | 13.2 | 8 | 3730 | 41 | |||||||

| SmartBiz | 18 | 2009 | $37 | Apply | SF | 11 May 2021 | 3 | 85,000 | 0 | 37 | 12 | 1015 | 71 | 1015 | 4.8 | |||||

| IOU Financial | 16 | 2011 | $132 | Apply | Atlanta | 11 May 2021 | 25 | 43,000 | 2.1 | 30 | 3 | 1310 | 50 | 408 | 4.6 | |||||

| SMBX | 13 | 2016 | $15 | Apply | SF | 11 May 2021 | 21 | 26,000 | 2.5 | 1.2 | 3 | 173 | 16 | 18 | 4.7 | Small Business Bonds Marketplace | ||||

| Bizfi | 13 | 2005 | $160 | Apply | NYC | 11 May 2021 | 14 | 1,200 | 0 | 160 | 207 | 5890 | 181 | 439 | 4.4 | Acquired by WBL in 2017 | ||||

| Credibly | 10 | 2010 | $77 | Apply | Detroit | 11 May 2021 | 16 | 12,000 | 0 | 77 | 4 | 5870 | 155 | 428 | 4.5 | |||||

| Honeycomb Credit | 10 | 2017 | $10.5 | Apply | Pittsburgh, PA | 12 May 2021 | 17 | 22,000 | 1.8 | 1.3 | ||||||||||

| ForwardLine | 8 | 2003 | $120 | Apply | SF | 11 May 2021 | 23 | 7,700 | 0 | 120 | ||||||||||

| Patch Lending | 7 | 2013 | $55 | Apply | LA | 11 May 2021 | 22 | 4,100 | 0 | 24.9 | 34 | 51000 | 36 | 15 | 4.4 | |||||

| Float Financial | 7 | 2021 | $1.3 | Apply | Honolulu | ||||||||||||||||

| SnapCap (LendingTree) | 6 | 2012 | Unknown | Apply | Charleston, SC | 65000 | ||||||||||||||

| Salaryo | 4 | 2017 | $12 | Apply | NYC | 11 May 2021 | 18 | 1,700 | 5.8 | 6.3 | 15 | 10 | ||||||||

| P2B Investor | 2 | 2012 | $33 | Apply | Denver | 11 May 2021 | 24 | 1,400 | 0 | 33.3 | 25 | 2720 | 14 | |||||||

| Channel Partners | 2 | 2009 | $50 | Apply | Minneapolis, MN | 1,400 | ||||||||||||||

| Lendr | 0 | 2011 | $25 | Apply | Chicago | 11 May 2021 | 29 | 1,200 | 0 | 25 | 1 | 613 | 39 | |||||||

| Lendinero | 0 | 2014 | $0 | Apply | Miami | 11 May 2021 | 28 | 500 | 0 | 0.03 | 9 | 960 | 28 | 7 | 4.3 | |||||

| Rapid Finance | 0 | 2005 | Unknown | Apply | Wash DC (Bethesda) | 60,000 | ||||||||||||||

| Lendvo | 0 | 2015 | $1.3 | Apply | Wash DC | 11 May 2021 | 26 | 4,200 | 0 | 1.3 |

Source: FintechLabs, 3 Feb 2022 from Crunchbase, SimilarWeb, SEMrush and other news sources

*FAB SCORE: The FAB score, Fintech Attention Barometer, is a proxy for the overall size of a private company since they typically do not release traditional metrics (# customers, deposits, AUM, etc). The score is based on VC funding, website traffic, mobile downloads, and the number of employees. It's a work in progress, so expect changes in the formula.

Definition: To qualify, challengers don't need to originate loans themselves or be regulated as a financial institution. Startups must focus on small-business credit/debt (eliminates Paypal, Amazon, Square) delivered digitally (rules out Wells Fargo, BofA, and the majority of traditional banks). We will include divisions of traditional FIs if they operate under a separate autonomous brand, such as American Express's Kabbage unit.

Lenders

| FAB Score* | Founded | Funding $M | ||

|---|---|---|---|---|

| http://fintechlabs.com/wp-content/uploads/2021/12/Murcury-logo-square.jpg | 447 | SF | 2017 | $152 |

| http://fintechlabs.com/wp-content/uploads/2022/01/Novo-logo-square.jpg | 327 | NYC | 2016 | $296 |

| http://fintechlabs.com/wp-content/uploads/2023/05/BluevineLogo.png | 260 | SF | 2013 | 768 |

| http://fintechlabs.com/wp-content/uploads/2023/02/Found-logo-600-300.png | 123 | SF | 2019 | $75 |

| http://fintechlabs.com/wp-content/uploads/2023/02/Logo-1.png | 101 | SF | 2021 | 181 |

| Company Overview | FAB Score* | Founded | Funding $M | |

|---|---|---|---|---|

| Ad | 2007 | $120,000 | NYC |

| 488 | 2020 | $950 | NYC |

| 362 | 2008 | 2500 | Atlanta |

| 309 | 2015 | 699 | Toronto |

| 282 | 2013 | $768 | SF |

| Company | FAB Score* | Founded | Funding ($M) | |

|---|---|---|---|---|

| 1058 | 2019 | $1,660 | NYC |

| 460 | 2008 | $401 | SF |

| 205 | 2016 | $312 | |

| 200 | 2016 | $418 | Utah |

| 196 | 2019 | $368 | NYC |

| FAB Score* | Founded | Funding ($M) | ||

|---|---|---|---|---|

| 230 | 2016 | $881 | SF | |

| 122 | 2017 | $520 | SF |

| 80 | 2017 | $306 | Wash DC |

| 63 | 2005 | $0 | London |

| 39 | 2015 | $142 | SF |